© Provided by The Financial Express Apart from that, Rs 10,000 crore is expected from corporate tax, income tax and some miscellaneous receipts.

© Provided by The Financial Express Apart from that, Rs 10,000 crore is expected from corporate tax, income tax and some miscellaneous receipts.The performance-linked incentive (PLI) scheme for mobile manufacturing is likely to ensure tax revenues (direct and indirect) to the tune of over Rs 80,000 crore to the government over the next. PLI improves the safety and quality of living for residents of the City of Pittsburgh through the administration and enforcement of the Pittsburgh Building Code and Zoning Code and the regulation of business and trade licenses. Practising Law Institute Continuing Legal Education.

The performance-linked incentive (PLI) scheme for mobile manufacturing is likely to ensure tax revenues (direct and indirect) to the tune of over Rs 80,000 crore to the government over the next five years apart from making India a manufacturing hub for giants like Apple and Samsung.

As per officials in ministry of electronics and IT (Meity), the biggest chunk of tax revenue will come from goods and services tax (GST) which is likely to garner around Rs 72,000 crore from Rs 4 lakh crore worth of devices produced for the domestic market. The mobile phones are taxed at 18% slab rate of GST. Apart from that, Rs 10,000 crore is expected from corporate tax, income tax and some miscellaneous receipts.

The government has approved the 16 applications under the PLI scheme, which is expected to lead to a total production of more than Rs 10.5 lakh crore by the companies over the next five years. Out of the total production, around 60% will be contributed by exports of the order of Rs 6.5 lakh crore while Rs 4 lakh crore will be for local market.

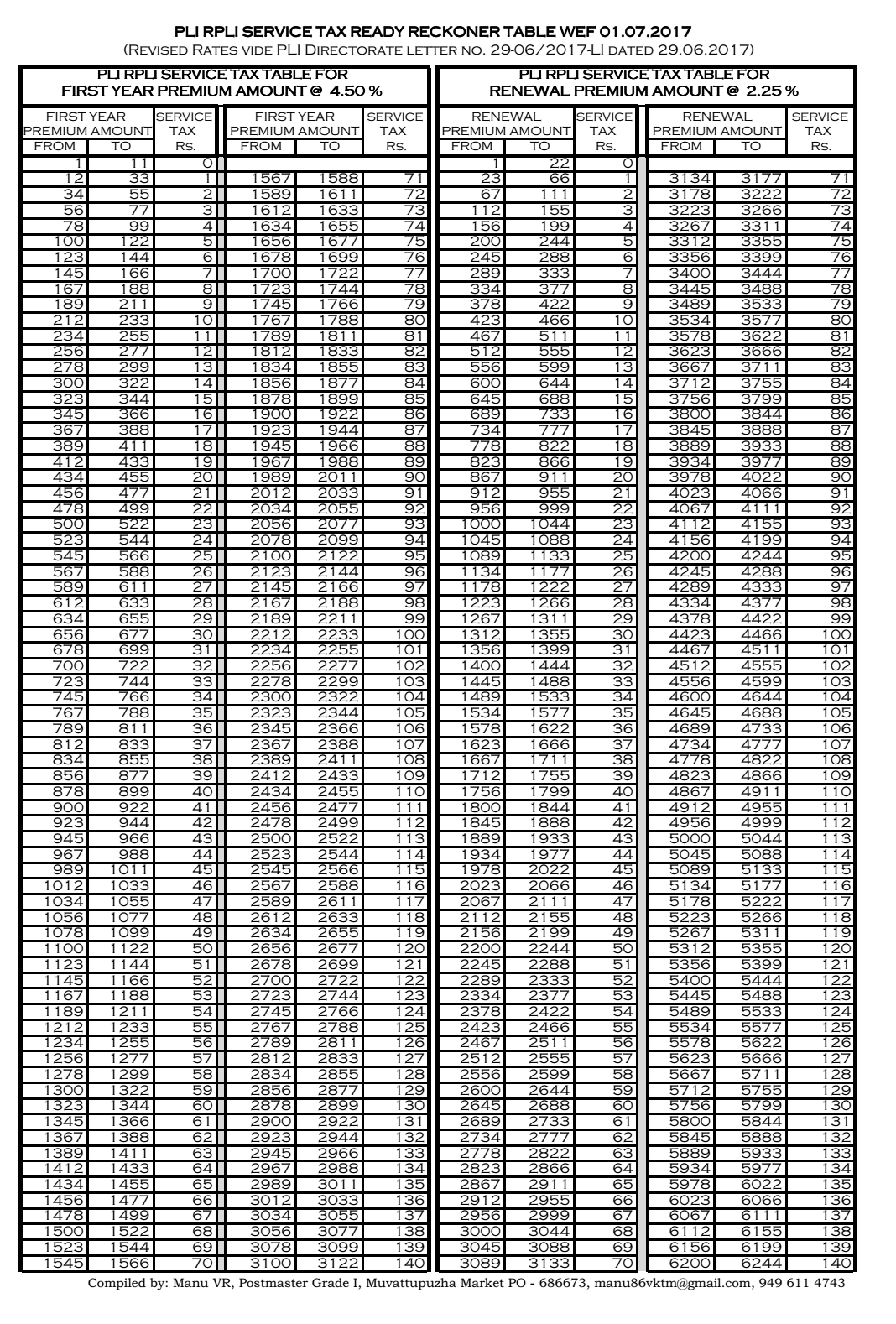

Pli/rpli Service Tax Table

Approximately more than two lakh direct jobs are expected to be created over the next five years while indirect employment opportunities are expected to number nearly three times that.

The objective of the scheme is to promote five global champions and five local champions and also promote firms in component manufacturing. The subsidy outlay for five global firms (invoice value of Rs 15,000 and above) is Rs 28,150 crore, approximately Rs 5,630 crore per company over five years. For local firms, the total incentive outlay is Rs 7,300 crore which is around Rs 1,460 crore per company over 5 years. For electronic components, 6 eligible applicants will be given Rs 900 crore as incentive.

Service Tax Online Payment

The international mobile phone manufacturing companies that have been approved under mobile phone (invoice value Rs 15,000 and above) are Samsung, Foxconn Hon Hai, Rising Star, Wistron and Pegatron. Out of these, 3 companies - Foxconn Hon Hai, Wistron and Pegatron are contract manufacturers for Apple iPhones. Apple (37%) and Samsung (22%) together account for nearly 60% of global sales revenue of mobile phones and this scheme is expected to increase their manufacturing base manifold in the country.

The local companies approved under the scheme are Lava, Bhagwati (Micromax), Padget Electronics, UTL Neolyncs and Optiemus Electronics. 6 companies are approved under the specified electronic components segment which include AT&S, Ascent Circuits, Visicon, Walsin, Sahasra, and Neolync.

Pli Rpli Service Tax After Gst

The PLI scheme for large scale electronics manufacturing was notified on April, 1, 2020, extending an incentive of 4% to 6% on incremental sales (over base year) of goods under target segments that are manufactured in India to eligible companies, for a period of five years subsequent to the base year (FY2019-20). Incentives are applicable under the scheme from August 1, 2020.